Table of Contents (click to expand)

A deficit can occur when a government spends more money than it earns. To make up for the difference, the government can borrow money by issuing bonds with a fixed interest rate to its own citizens or foreign countries, or by printing money.

As of January 2024, the US had a national debt of around US $34 trillion. Not just the US, all the biggest economies in the world have gigantic debts sitting in their balance sheets.

And, just for some perspective, let me remind you that a “trillion” has 12 zeros.

If all the major economies of the world have debts, then where will they get these new piles of cash from?

Well, to understand this situation fully, it’s time to brush up on some Economics 101.

Cash Flow

The game of money is the game of cash flow, i.e., the money coming to you (earning) and the money you give out (spending). When it comes to the government, their inflow of cash usually comes from taxes paid by the citizens. The government then uses this taxed money for building infrastructures, ramping up national security, running social programs, and undertaking other welfare activities.

However, when the spending of the government goes past the income it earns, it leads to a condition called a deficit. The deficit is the difference between a government’s actual income and spending. To make up for this difference, the government needs to borrow money—or perhaps ‘create’ money!

Recommended Video for you:

Three Ways By Which Government Raises Money

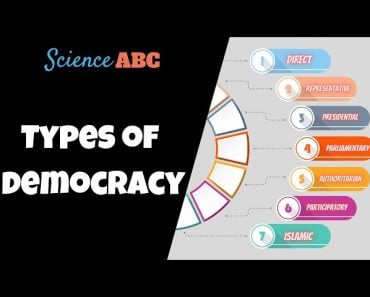

Formally speaking, there are three ways for the government to borrow money:

- From its citizens

- From other countries

- From itself

Citizens

Citizens of a nation lend money to their government, which adds to the national debt. This is the most secure way of raising money from an economist’s point of view. Many developed countries prefer this method of borrowing money.

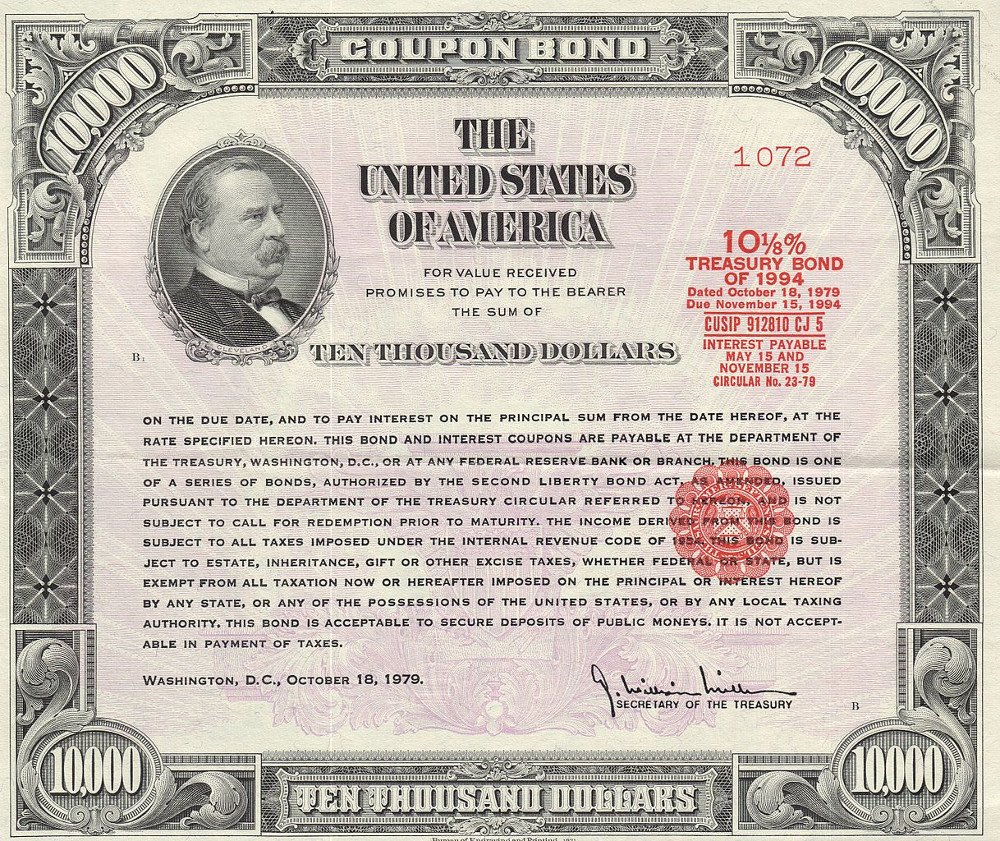

To do so, the government issues bonds with a fixed interest rate to be paid to the lender, called a coupon. This coupon could be paid quarterly, annually, or cumulatively at the end of its maturity. Maturity refers to the period for which the bond is issued, i.e., the duration you lend your money to the government. Certain bonds could take a few weeks or stretch up to 30 years.

Many people prefer to lend money to governments because of the sovereign guarantee that comes with it. This ensures that investors will receive their money back with a fixed amount of interest in the form of a coupon on their lent money.

Government bonds are considered to be one of the safest financial instruments since the government guarantees the return of the money after maturity, along with a fixed coupon as an interest payment for the money lent. Generally, the government does not default on interest and principal repayments.

Additionally, have you ever heard of a “debt” mutual fund? This type of fund primarily invests in a mix of debt or fixed-income securities, such as government securities, treasury bills, corporate bonds, etc.

The fund usually has a fixed rate of interest and is primarily considered a ‘safe investment’ because it’s an investment in the government, which will rarely default.

So, if you invest in debt mutual funds, especially those with vast exposure in government-issued bonds, you are essentially lending your money to the government.

Foreign Players

Just as it can do from its citizens, the government can also borrow money from foreign countries. The government can borrow money from foreign banks, international financial institutions, other foreign investors, such as World Bank and others, by issuing treasury bonds. In the US, these are called T-bonds.

However, one thing must be kept in mind: when a nation borrows money from overseas, i.e., resorts to foreign debt, the money borrowed is usually in a different currency than their own. Many economists are skeptical of this method of federal borrowing because, besides the usual obligation of interest payment on issued bonds, there is the risk of exchange rate fluctuations.

Say, for example, Brazil borrows from the US in US dollars and on the currency exchange, the value of the dollar goes up significantly against Brazilian real; suddenly, the outstanding foreign debt that Brazil owes to the US goes up significantly.

Talking about US foreign borrowing, the US borrows nearly one-third of its money from foreign countries. (Source).

Government Borrows From…itself!

Interestingly, the country can even borrow money from its own governmental institutions and subsidiaries.

Certain governmental agencies, such as the Social Security Trust Fund and the Office of Personnel Management Retirement, sometimes receive more tax revenue than they need. Instead of keeping this extra money locked up, these agencies buy US T-bonds and lend the money to the government instead.

Another way the government can borrow from itself is through the central banks. In many countries, central banks are controlled directly by the government. When the government runs out of money and doesn’t want to borrow from domestic or foreign investors, it can borrow from the central bank. The central bank will typically print new money and use it to buy government bonds, effectively loaning the government the money it needs. However, this can have negative consequences, as seen in Zimbabwe and Venezuela, where this practice led to currency crises.

Instead of improving the economy by increasing productivity, when the government tries to take a shortcut by printing money and flooding it into the system, it often brings undesirable results. Though this may give the pretense of a nation appearing rich, this method seldom works, as it generally leads to hyperinflation. Hyperinflation is a situation in which the prices of commodities and services rise very quickly.

This could be as much as 10% overnight or over 50% in a month! Whenever such events happen, the worthiness of currency goes down, and people need to hold on to a truckload of money to meet their primary day-to-day needs.

Take the case of Zimbabwe’s currency crisis, wherein to buy a packet of bread, people needed to bring suitcases full of money!

In this article, we covered just a few ways by which the government can borrow money. However, in the practical world, a country’s debt is much more complicated, involving hundreds of contributors and subtractors. From an economist’s point of view, borrowing from one’s own citizens is the cleanest way of taking on federal debt, followed by money borrowed from foreign investors/institutions. Governmental borrowing from central banks is generally considered shady or unnecessarily risky. When central banks dole out loans to the government, it often does so by printing more money.

This increases the money supply and thus increases the money in circulation, which creates the risk of alarming inflation or hyperinflation!

References (click to expand)

- Boskov, T. (2018). Venezuela Currency Crisis: Analysis Of The Causes. IJIBM International Journal of Information, Business and Management, 10(4), 119-125.

- Venezuela: The Rise and Fall of a Petrostate.

- Major Foreign Holders of Treasury Securities. ticdata.treasury.gov

- Masunda, S. (2012). Real exchange rate misalignment and currency crisis in Zimbabwe. Journal of Emerging Trends in Economics and Management Sciences, 3(6), 923-930.

- Is U.S. Government Debt Different? - Wharton Finance.